image source: longtermcare,gov

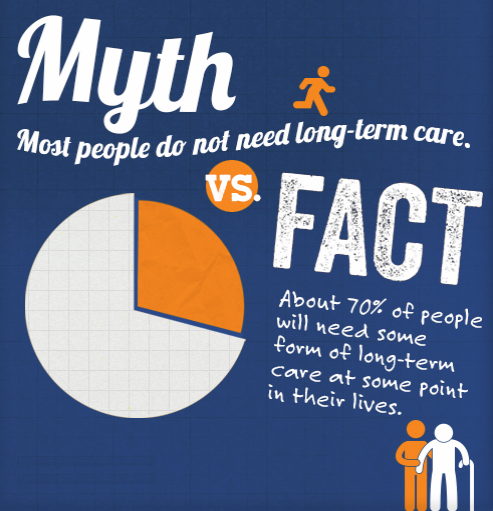

Nearly 70% of Americans age 65 and better will need some kind of help with activities of daily living as they age. The need for such help can stem from a debilitating disease, such as Alzheimer’s or Parkinson’s, or the decline of faculties, such as eyesight, hearing, balance or mobility, which comes naturally with aging.

When it comes to planning, many people confuse long-term care planning with long-term care insurance plans, but they are not the same. Long-term care planning means developing your strategy and making decisions now for how you will handle things later, should the need arise for assisted living or nursing home care. Long-term care planning includes strategies for how to pay for long-term care services, without draining your hard-earned money and assets. Long-term care insurance is different, in that it is just one of many strategies people consider for covering the costs of long-term care.

Recently, LongTermCare.gov, looked at the myths that may be keeping some from planning for long-term care, and ways you and your loved ones can prepare for the future. We will tell you why they are myths, and not realities, and why, if you haven’t done so already, you should start planning:

Myth 1: It’s too soon or too late for me to plan

It’s never too early, or too late, to start planning for long-term care. The best time to create your long-term care strategy is before you actually need long-term care. If you’re over 45, we recommend that you begin your planning now. Even if you are currently receiving services for yourself or a loved one, it’s still helpful to go through the planning steps. That way, you can be better informed, prepared, and in control of decisions ahead. Read our recent blog post entitled “Elder Law—It’s Not Just for Elders” for more details on when to start planning.

Myth 2: Medicare, Medicaid, or another government program will pay for it

Public programs, including Medicare and Medicaid, may help pay for some long-term care services. However, each program has specific rules about whether or not you qualify for benefits, what services are covered, how long you can receive benefits, and how much you have to pay in out-of-pocket costs. It is best not to assume that a government program will pay for long-term care services. In addition, when it comes to Medicaid, it can get rather complicated to complete and file the application, and it takes a Certified Elder Law Attorney, such as Evan H. Farr, to help you do so effectively. See our website for more details on Medicaid complexity and watch our “Bang Your Head Here” video.

Myth 3: It doesn’t cost that much

Long-term care is more expensive than most people think, and you will likely be responsible for paying out of your own pocket for the care you need. Nursing homes in Northern Virginia cost $12-$15K per month. For typical middle-class people who pay out of pocket, these costs will most likely drain all of their hard-earned assets pretty quickly. For more information, read our recent blog post “How Can I Afford a Nursing Home?”.

Myth 4: My current home is the best place to age

In thinking about long-term care, it is important to consider where you will live as you age and whether your place of residence can accommodate your needs should you become unable to fully care for yourself. Most people prefer to stay in their home or apartment for as long as possible. But, whether your home is “aging friendly” depends on its condition and whether it can be modified for someone with limited mobility. Another option is to move to a community or facility that is more supportive of long-term care needs. Read our recent blog post entitled “Remodel or Relocate” for more details about this topic.

Myth 5: My family will take care of me

Unpaid family members are the most common source of long-term care help. But, they may not be able to provide all the care you need, or be there every hour of the day. As part of your long-term care strategy, look into caregiving services in your area, including in-home care providers, elder daycare centers, and PACE programs. How can you choose the right service provider for your needs? If you live in Northern Virginia, be sure to check out the Trusted Referrals listed on Farr Law Firm, P.C. website.

Do you have a loved one who is in a nursing home or nearing the need for nursing home care? Or are you simply looking to plan ahead in the event nursing home care is needed in the future? Life Care Planning and Medicaid Asset Protection is the process of protecting your assets from having to be spent down in connection with entry into a nursing home, while also helping ensure that you or your loved one get the best possible care and maintain the highest possible quality of life, whether at home, in an assisted living facility, or in a nursing home. Learn more at The Fairfax and Fredericksburg Elder Law Firms of Evan H. Farr, P.C. website. Call 703-691-1888 to make an appointment for a consultation.

Print This Page