Whether your retirement is coming up soon or many years from now, it is important to protect your hard work and your golden years with effective retirement planning, including long-term care financial planning.

Whether your retirement is coming up soon or many years from now, it is important to protect your hard work and your golden years with effective retirement planning, including long-term care financial planning.

- 100% of retirees hope to take their last breath at home.

- Only 30% do; the other 70% wind up needing long-term care in a facility.

- Most retirement planning assumes that you will live a full and active life until you die in your sleep.

- But for most people, life won’t go that way. Health problems will often make retirement a long, slow, downward skid toward an undignified end.

- Most retirement plans don’t address this. That’s why so many people wind up broke, either becoming a burden or being forced into institutional care.

- Good retirement planning addresses this potentially catastrophic issue that so many people don’t want to talk about.

- If you want to do real retirement planning, you’ve come to the right place.

- PLEASE CALL THE FARR LAW FIRM AT 703-691-1888 TO SCHEDULE AN APPOINTMENT TO START YOUR RETIREMENT PLANNING

Retirement Planning

Evan Farr, besides being a Certified Elder Law Attorney, is also an experienced retirement planning advisor and long-term care financial advisor through his company Lifecare Financial Services, LLC (in business since 2006) and is highly knowledgeable about using annuities and other types of investments to provide safe retirement income and also helping to pay for long-term care using hybrid insurance policies and asset-based policies that combine life insurance or an annuity product (or both) with a long-term care benefit and using tax-free money (money in your IRA, 401(k), 403(b), or Thrift Savings Plan) to help pay for long-term care.

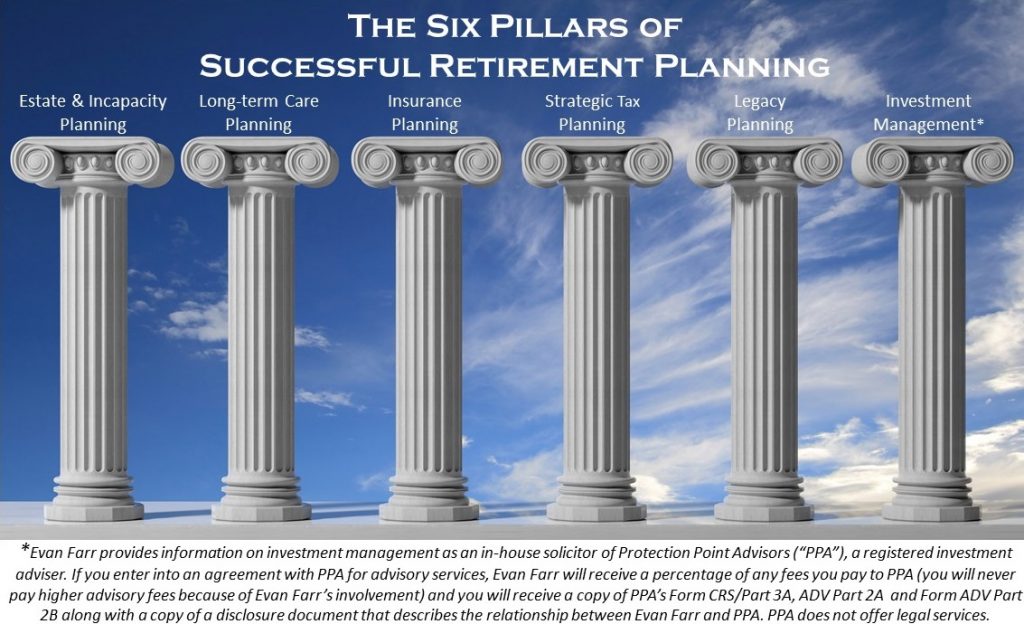

Our Retirement Planning Program is an educational program, personalized to each client, that Evan Farr has developed in conjunction with Protection Point Advisors (PPA), the Registered Investment Advisory firm with which Evan is affiliated, and Evan Farr’s insurance agency, Lifecare Financial Services, and its affiliated professionals. As you know, the legal services our firm provides are second-to-none. As for the financial planning and investment advice side, although Evan Farr is very good at these things, he acknowledges that he’s not great at either, which is why he has teamed up with PPA because they are a team of great financial planners and investment advisors. On the insurance planning side, again Evan is very good at everything dealing with life insurance and long-term care insurance hybrid products, but he’s not great at either, which is why he and his insurance company, Lifecare Financial Services, have teamed up with several other expert independent insurance professionals who dedicate their practice to focusing on the ins and outs and pros and cons of each type of insurance product.

There is no charge and no obligation for going through our personalized and educational Retirement Planning Program. If you choose to go through our Retirement Planning Program, our team will analyze your assets, your income, and your current insurance policies from a financial and retirement perspective, determine your financial goals and risk tolerance, and then educate you on the various options for best protecting the assets while also growing them, reducing exposure to market volatility as appropriate, and helping ensure that you have sufficient retirement income, all while also achieving optimal tax results to the greatest extent possible. We also explore all of the legal, financial, and insurance strategies available to help pay for long-term care should that expensive need arise. As part of this program, we will put together for you a comprehensive retirement plan and long-term care plan, involving all appropriate aspects of financial planning and retirement planning along with a long-term care plan which can utilize multiple types of long-term care insurance coverage as appropriate for your situation, including hybrid insurance coverage that combines a life insurance policy or an annuity with long-term care coverage.

If, after going through our Retirement Planning Program, you decide you want to use PPA to help manage your investments or Lifecare to help you obtain appropriate insurance coverage, an advantage of doing this is that Evan and the Farr Law Firm will be involved in the process of working with both companies to make sure your trust is properly funded, and you would have a professional team working with you every step of the way to ensure that your estate plan, your financial plan, and your long-term care plan are properly integrated and remain synchronized going forward. That being said, it is important to note that both Protection Point Advisors and Lifecare Financial Services are focused on financial and insurance education, just as the Farr Law Firm is focused on legal education, so there will never be any pressure to use any services.

To get started with our complimentary Retirement Planning Program, please sign these two forms: Financial Disclosure and Consent form and the Insurance Disclosure and Consent form. These documents explain my relationship with and allow the Farr Law Firm to share your information with, Protection Point Advisors and Lifecare Financial Services, so you don’t have to fill out new intake forms. Once you sign these forms, the next step is to call the Farr Law Firm and speak to Sierra, who can schedule an initial Zoom consultation to meet with Evan and Patrick Salimi; Patrick is one of the main financial professionals at PPA. Patrick and Evan and the rest of the team at PPA and Lifecare look forward to hopefully working with you to protect your retirement and financial prosperity.

For more information about PPA, including lots of free financial information and regular financial webinars, please visit https://www.protectionpointadvisors.com/evan-farr.

Long-term Care Planning

Evan can help you secure your future while also helping you secure the assets you may need to leave to your spouse, children, and grandchildren. Retirement planning is one of the most important aspects of estate planning, and the choices you make surrounding your retirement planning can affect you and your loved ones for decades to come.

When working with our estate planning clients who are also in the process of financial planning and retirement planning, the general goals are as follows:

- Reduce or eliminate exposure to market volatility.

- Consolidate assets for easier management — outside of your trust and inside of your trust if you have a trust.

- Guarantee account values while continuing growth opportunities.

- Develop financial strategies that will help pay for long-term care, especially home care and assisted living.

How Long Will You Live — Life Expectancy vs. Longevity?

Here’s the very basic Social Security Life Expectancy Table, which does not take your health into account at all. However, how much in savings you will likely need for retirement, and whether you should consider purchasing some type of long-term care insurance or hybrid long-term care insurance coverage, depends a great deal on how long you actually expect to live, i.e., your expected longevity, which is based not just on your current age and gender, but also on your family health history, smoking and drinking habits, exercise patterns, stress level, and other important lifestyle choices. Below are several longevity calculators that attempt to calculate your actual probability of living beyond your life expectancy. we have identified as particularly detailed (although we of course cannot yet vouch for their accuracy):