Q. My mother has lived alone for the past three years since my father passed away. She is starting to get lonely and needs more help these days. I recently started looking into in-home care as an option. I knew it would be expensive, but decided it was time to spend the money and get my mother the help that she needs to continue to stay in her own home for as long as possible.

Q. My mother has lived alone for the past three years since my father passed away. She is starting to get lonely and needs more help these days. I recently started looking into in-home care as an option. I knew it would be expensive, but decided it was time to spend the money and get my mother the help that she needs to continue to stay in her own home for as long as possible.

I called several home health care agencies in the DC area for quotes and experienced sticker shock, to say the least. The cost went up so much since we needed the same type of help for my father just a few years ago! Is this just happening locally, since everything seems to be pricey here, or is it happening nationally, as well? Has assisted living and nursing home care also increased in cost, and if everything is increasing so much, how can I afford the care that my mother needs now and will likely need in the future?

A. You are completely correct in your assessment that the cost of home care is rising dramatically, and it’s happening here and all over the country. In fact, according to the 2019 Genworth Cost of Care Survey, the fastest-rising long-term care costs are no longer for the most skilled care – in a facility, they’re now for the least-complex care – at home.

Each year, Genworth conducts the Cost of Care Survey, which measures the cost of care across different care settings, including nursing homes, assisted living facilities, adult day health facilities and home care providers. To arrive at the data, Genworth contacted 53,901 long term care providers nationwide to complete 15,178 surveys. The survey includes 441 regions and the results provide an apples-to-apples comparison of the cost-of-care throughout the U.S.

Why Are Home Care Costs Rising So Much?

For years, there has been a shortage of care professionals and we are almost at the point where there are not enough care professionals to meet the increasing demand for in-home care. Besides the lack of qualified workers, there are several reasons why the costs are rising and continue to rise for in-home care:

• The pay is low and the labor market is tight: Because of the tight labor market, the competition for care professionals is intense. Non-medical agencies are now competing with hospitals, assisted living facilities and other service-based industries by offering higher pay and benefits, which ultimately drives up the cost of providing in-home care services.

• In-home healthcare workers often have multiple jobs/opportunities: Thanks to advancements in mobile technology and recruitment techniques, these highly sought-after care professionals have instant access and exposure to job offers, in many cases, up to three new opportunities a week. As a result, these mostly part-time workers may be working with multiple agencies, accepting jobs that best meet their schedules.

• The costs of complying with the new mandates in local, state and federal certifications and regulations, including revised minimum wage and overtime laws in some states, are high; and

• There has been a shift in post-acute Medicare reimbursement that is spurring hospitals to discharge patients sooner and with greater care needs. It stemmed from a change from a fee-based to value-based Medicare payment system that has resulted in the reduction of skilled nursing days provided to patients following their release from a hospital. As a result, many patients are sent home with more acute care needs and costly care needs often not covered by Medicare.

The U.S. Department of Labor projects the demand for home health aides and personal aides will increase 36%, from 3.2 million to 4.4 million, in the next 10 years!

“The trends driving up the cost of care should be concerning to families,” said Tafa Jefferson, founder and CEO of Amada Senior Care, which provides in-home senior care through corporate- and franchise-owned home care agencies in 39 states. “They should have the uncomfortable discussion about how they plan to finance long term care, something we’re all going to have to address.”

Costs Are Rising Across All Care Settings, But Not as Much as Home-Care!

While home care costs increased the most, adult day health care services followed close behind with a 4.17% increase. In contrast, the cost of care in facilities has stabilized during the past year with increases ranging from 1-2% for assisted living facilities and nursing homes.

The national annual median cost of care now ranges from $102,200 for a private room in a nursing home to $19,500 for adult day health care services (based on five days per week per year). A new category in this year’s Cost of Care Survey is in-home skilled nursing at a national median cost of $87.50 per visit. Click here for national median hourly, daily, monthly and annual costs for each care setting.

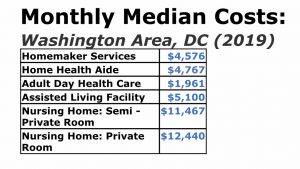

Costs are as follows in our area:

Paying for Long-term Care

As you can see from the chart above, long-term care is extremely expensive. With long-term care services being so costly, how can anyone afford them without going broke or depleting their assets? Medicare will pay for a small amount skilled home health after a hospitalization, but most home care and homemaker services are paid out of pocket. Medicare will also pay for short-term rehabilitation that takes place in a nursing care or rehab center following a three-day hospital inpatient stay. But, Medicare does not pay for long-term care!

Medicaid, on the other hand, is the single largest payor of long-term care costs because so many people can’t afford to cover the costs themselves. However, Medicaid has different income and functionality requirements, making it extremely difficult to qualify, so the help of an experienced elder law attorney, such as myself, is absolutely essential.

Genworth includes the following extremely truthful quote in their survey findings: “It usually takes personal experience caring for a parent or other family member for people to realize the enormous costs associated with long term care and wake up to the fact that they themselves need to do a better job of planning ahead for how they will cover these costs.”

Planning for Long-term Care

When it comes to planning for long-term care, Medicaid Asset Protection Planning can be started while your loved one is still able to make legal and financial decisions, or can be initiated by an adult child acting as agent under a properly-drafted Power of Attorney, even if your loved one is already in a nursing home or receiving other long-term care. In fact, the majority of our Lifecare Planning and Medicaid Asset Protection Planning clients come to us when nursing home care is already in place or is imminent.

Generally, the earlier someone plans for long-term care needs, the better. But, fortunately, it is never too late to begin your planning.

To afford the catastrophic costs of long-term care without depleting all of her hard-earned assets, your mother should begin her Long-Term Care Planning as soon as possible. You both should also do Incapacity Planning and Estate Planning, if you haven’t done so already. Please call us to make an appointment for an initial consultation:

Elder Law Fairfax: 703-691-1888

Elder Law Fredericksburg: 540-479-1435

Elder Law Rockville: 301-519-8041

Elder Law DC: 202-587-2797