Living Trust Plus® Veterans Asset Protection Trust

Living Trust Plus® Income Retention Trust

Introduction

Whether you’re rich, poor, or somewhere in between, you cannot afford to ignore the potentially devastating costs of nursing home care and other types of long-term care. Nursing homes are the most likely and one of the most expensive creditors that most Americans are likely to face in their lifetimes.

Evan Farr is the creator of the Living Trust Plus® — a Medicaid Asset Protection Trust PLUS a Veterans Asset Protection Trust PLUS a lawsuit protection trust PLUS a probate protection trust — used by approximately sixty attorneys across the United States.

Please read this page for more information about the Living Trust Plus® and click here to contact us for an appointment.

Please click below to watch a 75-minute webinar all about the Living Trust Plus Medicaid Asset Protection Trust and Veterans Asset Protection Trust.

Please scroll to the bottom of this page for 3 flowcharts showing how each of the three versions of the Living Trust Plus operates.

2-Hour Educational Webinar Discussing all Four Levels of Planning

Please click below to watch a two-hour webinar on the Living Trust Plus 4 Levels of Lifetime Protection Planning, including Level 3 Planning which includes the Living Trust Plus Medicaid Asset Protection Trust and Living Trust Plus Veterans Asset Protection Trust along with how it fits into all of our Four Levels of Planning.

Frequently Asked Questions

Please click here for a list of Frequently Asked Questions about the Living Trust Plus, Medicaid Asset Protection Trust and Veterans Asset Protection Trust.

Consider the following statistics:

- About 70% of Americans who live to age 65 will need long-term care at some time in their lives, over 40 percent in a nursing home.

- As of 2023, the cost of a private room in a nursing home in the Washington, DC Metro area is over $190,000 per year for a semi-private room.

- On average, someone age 65 today will need nursing home care for approximately three years. Twenty percent of individuals will need nursing home care for more than five years.

- Fifty percent of all couples and 70 percent of single persons become impoverished within one year after entering a nursing home.

- Long-term care is not just needed by the elderly. A study by a large insurance company found that 46 percent of its group long-term care claimants were under the age of 65 at the time of disability.

- Contrast the above long-term care statistics with statistics for automobile accident claims and homeowner’s insurance claims:

- An average of only about 7% of people per year file an automobile insurance claim.

- An average of only 6% of people per year file a claim on their homeowner’s insurance.

Almost everyone who drives has auto insurance, and almost everyone who owns a home has homeowner’s insurance, yet less than 10% of the population has long-term care insurance. The other 90% are totally at risk for winding up financially destitute because of the need for nursing home care.

A Revocable Living Trust Protect Does NOT Protect Assets from Nursing Home Care and Other Creditors

No! A revocable living trust protects your assets from the expenses of probate but does not protect your assets from the expenses of long-term care while you’re alive. A revocable living trust can be designed to protect assets from the creditors of your beneficiaries after you die, but this does not help you while you’re alive. A revocable living trust provides NO asset protection at all for you while you’re alive. Since you have total access to the assets inside your revocable living trust, so do your creditors, including the most likely and most expensive creditor of all – nursing homes.

What’s The Solution? The Living Trust Plus®

In response to this problem, I have developed a unique solution – a special type of irrevocable asset protection trust called the Living Trust Plus® — a living trust that functions very similarly to a revocable living trust and maintains much of the flexibility of a revocable living trust but protects your assets from the expenses and difficulties of probate PLUS the expenses of long-term care while you’re alive, PLUS lawsuits and a multitude of other financial risks during your lifetime, PLUS Veteran’s Aid and Attendance benefits for qualified veterans, PLUS Medicaid.

The Living Trust Plus Medicaid Asset Protection Trust protects your assets from lawsuits, auto accidents, creditor attacks, medical expenses, and — most importantly for the 99% of Americans who are not among the ultra-wealthy — from the catastrophic expenses often incurred in connection with nursing home care.

For most Americans, the Living Trust Plus Medicaid Asset Protection Trust is the preferable form of asset protection trust because, for purposes of Medicaid eligibility, this type of trust is the only type of self-settled asset protection trust that allows a settlor to retain an interest in the trust while also protecting the assets from being counted by state Medicaid agencies.

Even though the Living Trust Plus Medicaid Asset Protection Trust is “irrevocable” by the Settlor(s) acting alone, it can still be terminated so long as the trustee and all of your beneficiaries agree to terminate it. Additionally, you retain a very high degree of control over your trust assets because:

- you (and your spouse) can be the trustee(s) if desired, which means you retain investment control over the assets, including the right to sell any trust-owned real estate and any financial asset owned by the trust, with the proceeds from said sale staying in the trust and you, as trustee, retaining the ability to use those assets to purchase alternate assets owned by the trust;

- you retain the right to live in and use your real estate;

- you retain the right to change trustees; and

- you retain the right to change beneficiaries.

Please click here for more information about the Living Trust Plus Asset Protection Trust.

Many people wonder if they can accomplish the same purpose of the Living Trust Plus by simply giving their assets away to their children directly. This is generally a very bad idea for many reasons. If a parent transfers assets directly to one or more children, numerous risks are created that could result in the loss of some or all of the gifted assets, or serious negative tax consequences:

- possible lawsuits or other creditor claims against the child;

- divorce of the child;

- poor spending habits of the child;

- the need for financial aid of a grandchild;

- the loss of step-up in basis for capital gains tax purposes;

- the loss of the $250,000 capital gains exclusion if you give away your primary residence.

Please click here for information about the dangers of outright gifting instead of using the Living Trust Plus Asset Protection Trust.

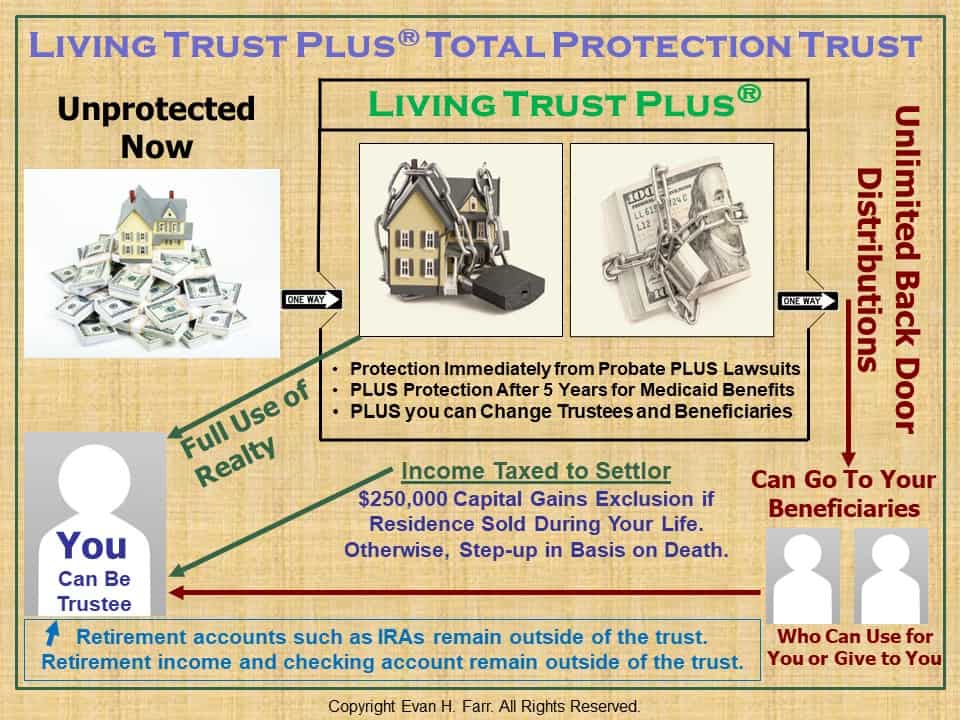

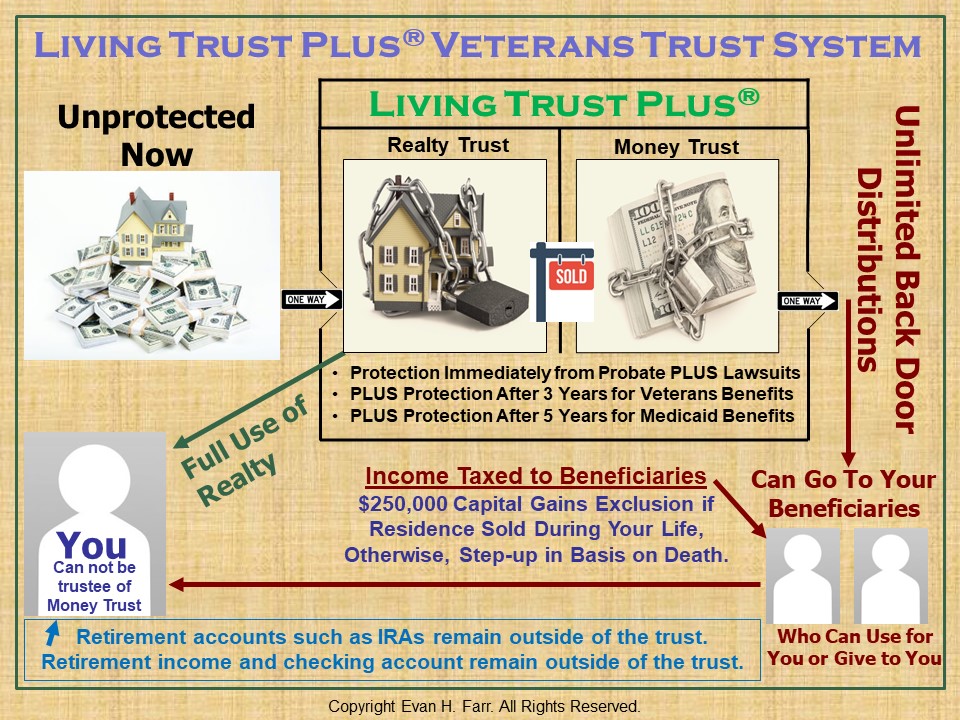

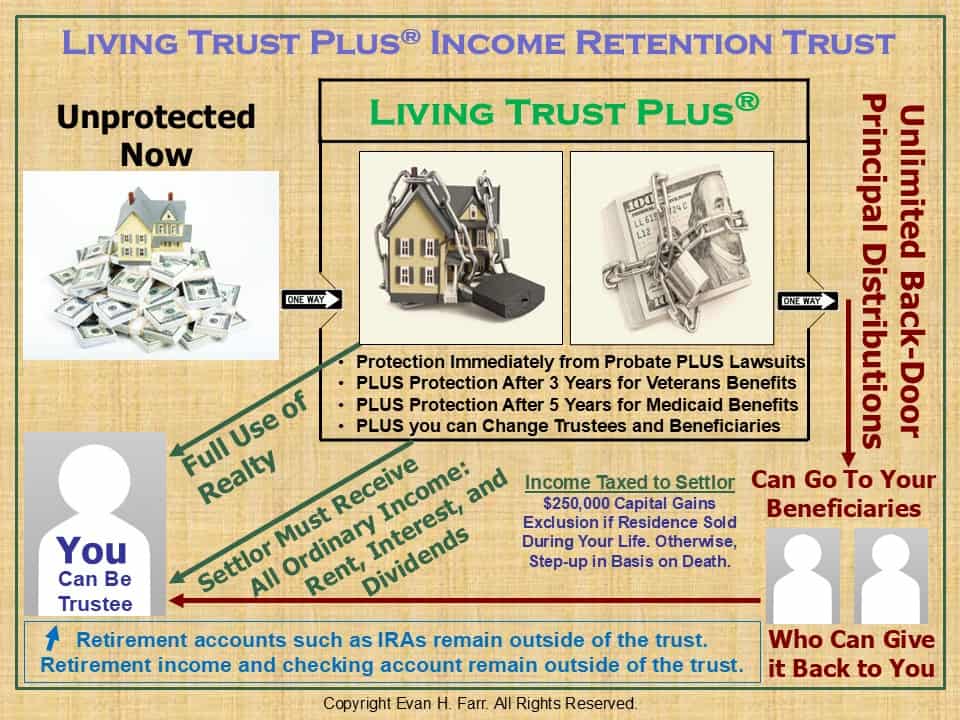

Below are three diagrams showing how the Living Trust Plus Medicaid Asset Protection Trust can operate. There are three different versions of the Living Trust Plus Medicaid Asset Protection Trust. In all versions, the $250,000 capital gains exclusion ($500,000 for a married couple) is preserved on the sale of the primary residence (assuming all other requirements are met); if the primary residence is not sold during the lifetime of the settlor(s), then the full step-up in basis is preserved upon the death of the settlor(s).

In the first version, which is most often recommended, the trust creator retains no ability to receive distributions directly from the trust. This version is simpler to operate mechanically and for tax purposes than the second and third versions. With the first version, the Living Trust Plus Total Protection Trust, the trust maker is taxed on all income generated by trust assets (though the trust maker does not receive the income, which is simply reinvested inside the trust).

The second version works best for Veterans desiring to protect assets in connection with the Veterans Aid and Attendance Benefit and Medicaid. With the second version, the Living Trust Plus Veterans Trust, the trust beneficiaries are taxed on all income generated by trust assets, though the beneficiaries may or may not request to receive the income.

The third version provides that the creator of the trust receives annual distributions of all ordinary income directly from the trust. This third version, called the “income distribution trust” and sometimes called an “income-only trust,” protects your assets from probate PLUS lawsuits, PLUS nursing home expenses (like the other two versions), but is more complicated to operate and does not protect your income from going to the nursing home or from counting towards your income in connection with the Veterans Aid and Attendance Benefit. The “income-distribution” version of the trust is most often used by individuals who rely on monthly rental income to maintain their standard of living.

Living Trust Plus® Total Protection Trust

Living Trust Plus® Veterans Version

- Medicaid Asset Protection Trust (2-Trust System)

- Veterans Pension Asset Protection Trust (2-Trust System)

- Veterans Aid and Attendance Protection Trust (2-Trust system)

- Lawsuit Asset Protection Trust (2-Trust system)

Living Trust Plus® Income Retention Trust

- Living Trust Plus® Income Retention Trust

- This Version is Required to Retain the Right to Obtain a Reverse Mortgage

- Medicaid Asset Protection Trust

- Medicaid Income-Only Trust

- Lawsuit Asset Protection Trust

- With any of the 3 versions of this trust, what happens after death, typically, is that we have your trust split into multiple Beneficiary Asset Protection Trusts for each of your beneficiaries.

For Attorneys

If you’re an attorney interested in more information about the Living Trust Plus Asset Protection System, please click here for licensing information.

Print This Page