Last Updated: 12/4/2024 (unless otherwise noted)

Below are figures for 2025 that are frequently used in the elder law practice, including the figures for spousal impoverishment, penalty divisors, and more, for Virginia, Maryland, and the District of Columbia (DC). Medicare premiums and co-pays, Social Security Disability, and Supplemental Security Income are also covered.

Medicaid Figures:

Medicaid is the primary funding source for long-term care for millions of disabled and elderly middle-class Americans, providing vital long-term care coverage to those who qualify for the benefit.

Although the federal government establishes general guidelines for the program, states design, implement, and administer their own Medicaid programs. The federal government matches state expenditures on medical assistance based on the federal medical assistance percentage, which can be no lower than 50 percent. In fiscal year 2019, total Medicaid spending was $616 billion — all of which is of course funded by your tax dollars. If you are smart enough to do legal planning to get some of these tax dollars back to pay for your long-term care when you need it, it’s ethically no different than income tax planning, when you try to get the biggest income tax refund every year by claiming all the legal tax deductions and tax credits you’re entitled to.

Virginia/Maryland/DC Medicaid Numbers:

Divestment Penalty Divisors

A Penalty Divisor, also called a Divestment Penalty Divisor, is intended to represent the average cost of private-pay nursing home care in the state in which one resides. The Penalty Divisor varies in each state, and in Virginia varies based on the geographic region within the state.

Northern Virginia Penalty Divisor: $9,268.00/month – Northern Virginia (Alexandria, Arlington, Fairfax, Falls Church, Loudoun, Manassas, Prince William)

Rest of Virginia Penalty Divisor: $7,023/month

DC Penalty Divisor: $14,563.96 (up from $13,704) /month

Maryland Penalty Divisor: $10,342/month

Individual Resource Allowances

Virginia Individual Resource Allowance: $2,000

Maryland Individual Resource Allowance: $2,500

DC Individual Resource Allowance: $4,000

Click here for a list of the Individual Resource Allowance in all the states.

Married Couple Resource Allowances (when both spouses are applying for Medicaid)

Virginia Married Couple Resource Allowance: $4,000

Maryland Married Couple Resource Allowance: 3,000 per spouse; after 6 months, $2,500 per spouse.

DC Married Couple Resource Allowance: $6,000

Click here for a list of the Individual Resource Allowance in all the states.

Monthly Personal Maintenance Allowance

$40 (Community-Based Care PMA is 165% of SSI Level (rounded up to the nearest dollar, so $1,509 for 2024 based on SSI Level of $914 (See M1470.410)

Maryland Monthly Personal Maintenance Allowance: $102

DC Monthly Personal Maintenance Allowance: $103.20

(The PNA is adjusted annually by the federal COLA.

DC EPD Waiver Personal Needs Allowance is equal to 300% of the SSI Federal benefit rate: $2,829 for 2024

Community Spouse Monthly Housing Allowance / Shelter Standard / Excess Shelter Allowance

Established each July 1 by CMS

The Community Spouse Monthly Housing Allowance, sometimes called a Shelter Standard or Excess Shelter Allowance, is intended to account for expenses such as rent, mortgage, property taxes, and homeowners’ insurance. Based on the community spouse’s actual shelter costs and the federally set housing allowance, they might be entitled to a higher Spousal Income Allowance.

VA Shelter Standard: $766.50 (up from $739.50)

MD Shelter Standard:$766.50 (up from $739.50)

DC Shelter Standard: $766.50 (up from $739.50)

Standard Utility Allowance

The Standard Utility Allowance (SUA) is an average monthly utility cost established by each state generally updated each October. Utilities may include cooling/heating, electricity, basic phone service, sewage, garbage, and water. This figure may vary and be called a Limited Utility Allowance (LUA) based on whether one pays heating and cooling costs separately from their rent and what other utilities one pays.

Virginia Standard Utility Allowance: $551

Maryland Standard Utility Allowance (LUA) if heat is included in rent: $309

Maryland Standard Utility Allowance (SUA) if heat is not included in rent: $551

Medicaid Home Equity Limits

Established each Jan 1 by CMS:

Virginia Medicaid Home Equity Limit: $713,000 (up from $688,000)

Maryland Medicaid Home Equity Limit: $713,000 (up from $688,000)

DC Medicaid Home Equity Limit: $1,097,000 (up from $1,071,000.00)

Community Spouse Resource Allowance

Established each Jan 1 by CMS:

Minimum Community Spouse Resource Allowance (except in Alaska and Hawaii): $30,828

Maximum Community Spouse Resource Allowance (except in Alaska and Hawaii): $154,140

Community Spouse Monthly Maintenance Needs Allowance

Established each Jan 1 by CMS:

Minimum Monthly Maintenance Needs Allowance (except in Alaska and Hawaii): $2,555

Maximum Monthly Maintenance Needs Allowance (except in Alaska and Hawaii): $3,948

For CMS’s complete chart of 2025 SSI and Spousal Impoverishment Standards, click here.

Virginia Medicaid CCC Plus Waiver Caregiver Payments

Rates Effective 7/1/2024 and apply to Personal Care, Respite Care, and Companion Care

Agency Directed Northern Virginia: $23.34

Agency Directed Rest of Virginia: $19.83

Consumer Directed Northern Virginia: $17.62

Consumer Directed Rest of Virginia: $13.61

Assisted Living Benefits / Adult Foster Care Benefits:

Virginia Auxiliary Grant Figures for Assisted Living Facilities:

As of 1/1/2024: Northern Virginia Income Limit: $2,391 (up from $1,934) (+ $20 income exclusion)

As of 1/1/2024: Rest of Virginia Income Limit: $2,079 (up from $1,682) (+ $20 income exclusion)

Personal Maintenance Allowance: $87

Maryland Senior Assisted Living Subsidy (SALS):

Recipients must need the nursing home level of care.

Net monthly income may not be higher than 60 percent of the State median income.

The maximum subsidy paid directly to the provider is $1,056/month as of 1/1/2024.

$130/month personal allowance deduction

Maryland Medicaid Assisted Living Waiver (Part of Home and Community-Based Options Waiver)

Recipients must need the nursing home level of care.

Net monthly income may not be higher than 300 percent of the SSI Federal Benefit Rate, but can use income spend-down on a 6-month budget period to qualify.

The maximum amount paid directly to the ALF is $3,800/month as of 1/1/2024.

Maryland Medicaid Monthly Personal Maintenance Allowance: $93

DC Assisted Living Facilities, Including Those That Accept the Medicaid EPD Waiver

DC Optional State Supplemental Payment (OSSP) Program for Adult Foster Care Homes, aka Certified Residential Facilities (CRFs)

Note: most of the facilities are small group homes, and their addresses are not published by DC for security reasons.

Individual

| Code | Federal | State | Combined |

|---|---|---|---|

| O/S A | $943 | $674.16 | $1617.16 |

| O/S B | $943 | $784.16 | $1727.16 |

| O/S G* | $30 | $73.20 | $103.20 |

Couple

| Code | Federal | State | Combined |

|---|---|---|---|

| O/S A | $1415 | $1704.32 | $3119.32 |

| O/S B | $1415 | $1924.32 | $3339.32 |

| O/S G* | $60 | $146.40 | $206.40 |

O/S A – Adult Foster Care with 50 or fewer beds

O/S B – Adult Foster Care with more than 50 beds

O/S G* – Medicaid Facilities

Veterans Aid and Attendance Figures:

Here are the 2025 VA Aid and Attendance Amounts:

Single Veteran: $2,358 per month

Veteran with One Dependent: $2,796 per month

Spouse of a Living Veteran: $1,851 per month

Husband & Wife Both Veterans: $3,473 per month

Surviving Spouse of Veteran: $1,516 per month

Sources:

Veterans Pension Rate Table

Surviving Spouse Pension Rate Table

Click here for all Veterans Aid and Attendance Figures and Rules.

Gift and Estate Tax:

Gift Tax Annual Exemption in 2025: $19,000 (up from $18,000 in 2024)

Gift Tax Lifetime Exemption in 2025: $13.99 million (up from 13.61 million in 2024); please note this is currently slated to be cut to approximately 6 million in 2026.

Please read this FAQ to understand the Annual Gift Tax Exemption and the Dangers of Gifting in Connection with Medicaid.

Medicare

Medicare is the federal government program that provides health insurance if you are 65-plus, under 65 and receiving Social Security Disability Insurance (SSDI) for a certain amount of time, or under 65 and with End-Stage Renal Disease (ESRD). Medicare has been protecting the health and well-being of American families and saving lives for five decades.

Below are the Medicare amounts and how they have changed for the coming year:

Medicare Part A

Medicare Part A covers inpatient hospitals, skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,676 in 2025, an increase of $44 from $1,632 in 2024. (Note that certain Medigap plans do cover your Part A deductible.) You’ll pay the Part A deductible for each inpatient hospital or skilled nursing facility (SNF) benefit period — a new benefit period starts if you haven’t received inpatient hospital care or SNF care for 60 days in a row.

2025 Part A premium

No premium – for most beneficiaries who paid into Medicare through payroll taxes.

$285/month in 2025 – for those who worked/paid into Medicare between 7.5 and 10 years ($278 in 2024)

$518/month in 2025 – for those with a work history of less than 7.5 years ($1 less than $505.month in 2024)

2025 Part A deductible

2025: $1,676

2024: $1,632

(Covers up to 60 days in the hospital)

Daily coinsurance for 61st-90th Day

2025: $419

2024: $408

Daily coinsurance for lifetime reserve days

2025: $838

2024: $816

Skilled Nursing Facility coinsurance

2025: $209.50

2024: $204

Deductible is per benefit period, NOT per year. Once a beneficiary has been out of the hospital for at least 60 days, a new benefit period would start if and when they needed to be hospitalized again. Supplemental coverage, including Medigap plans, will pay some or all of the Part A deductible on your behalf.

Medicare Part B Premiums/Deductibles (2025)

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024. The annual deductible for all Medicare Part B beneficiaries will be $257 in 2025, an increase of $17 from the annual deductible of $240 in 2024.

The increase in the 2025 Part B standard premium and deductible is mainly due to projected price changes and assumed utilization increases that are consistent with historical experience.

Beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant, and who do not have certain other types of insurance coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2025, the standard immunosuppressive drug premium is $110.40.

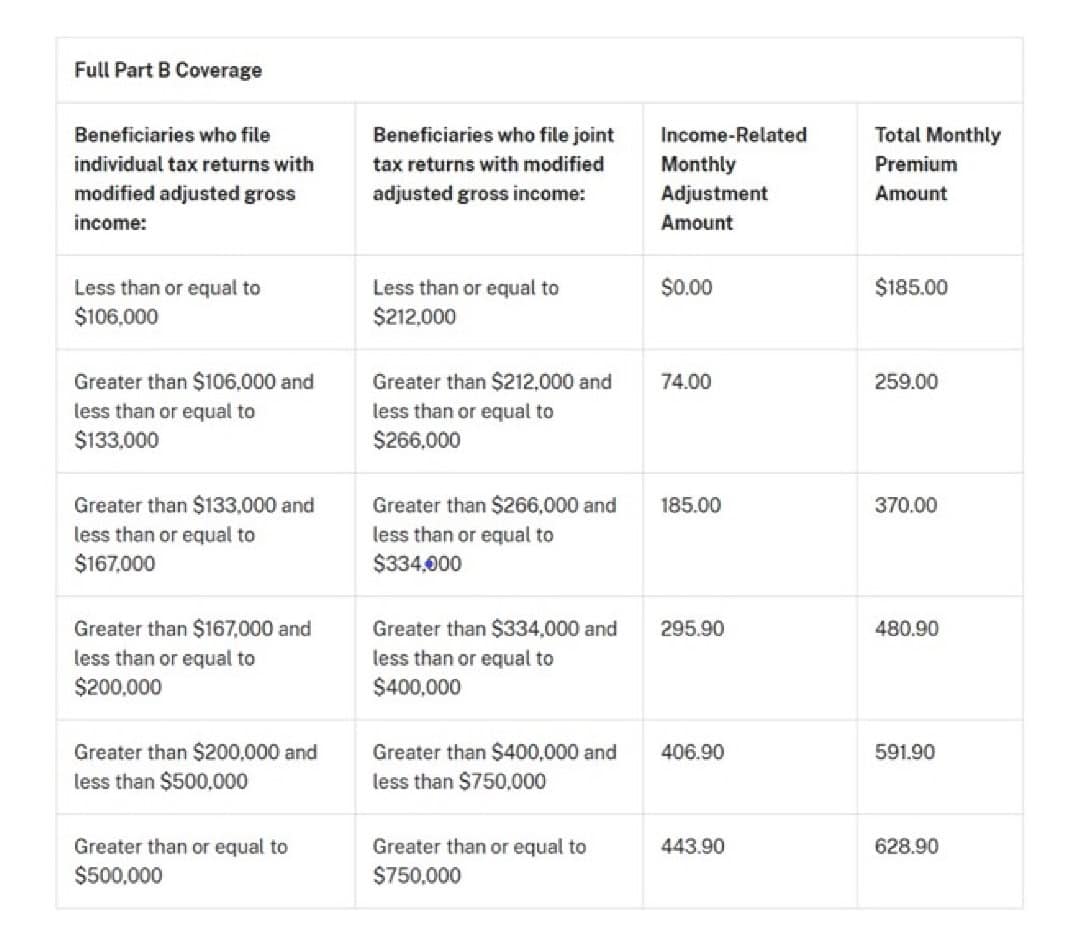

2025 Medicare Part B Income-Related Monthly Adjustment Amounts

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8% of people with Medicare Part B. The 2025 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

2025 Medicare Part D Premium by Income

Since 2011, a beneficiary’s Part D monthly premium has been based on his or her income. Approximately 8% of people with Medicare Part D pay these income-related monthly adjustment amounts. These individuals will pay the income-related monthly adjustment amount in addition to their Part D premium. Part D premiums vary by plan and, regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare. Roughly two-thirds of beneficiaries pay premiums directly to the plan while the remainder have their premiums deducted from their Social Security benefit checks.

—–

Social Security and Supplemental Security Income

More than 72 million people depend on Social Security’s benefit programs, so annual changes to the program and its payouts are always highly anticipated. Substantially higher benefit checks have been a rarity in recent years. In 2025, Social Security recipients will see a 2.5 percent increase in their benefits and Supplemental Security Income (SSI) payments.

Federal benefit rates increase when the cost-of-living rises, as measured by the Department of Labor’s Consumer Price Index (CPI-W). The CPI-W rises when inflation increases, leading to a higher cost of living. This change means prices for goods and services, on average, are higher. The cost-of-living adjustment (COLA) helps to offset these costs. As we are still struggling with inflation, the extra money will help seniors and others make ends meet!

Retirement Earnings Test Exempt Amounts

Under full retirement age*

2025: $22,320/yr. ($1,860/mo.)

2024: $23,400/yr. ($1,950/mo.)

*One dollar in benefits will be withheld for every $2 in earnings above the limit.

The year an individual reaches full retirement age**

2025: $62,160/yr. ($5,180/mo.)

2024: $59,520/yr. ($4,960/month)

Social Security Disability Thresholds

Non-Blind:

2025: $1,620/month

2024: $1,550/month

Blind:

2025: $2,700/month

2024: $2,590/month

Maximum Social Security Benefit: Worker Retiring at Full Retirement Age

2025: $4,018/month

2024: $3,822/month

SSI Federal Payment Standard

Individual:

2025: $967/month

2024: $943/month

Couple:

2025: $1,450/month

2024: $1,415/month

Estimated Average Monthly Social Security Benefits Payable in January 2025

All Retired Workers:

2025: $1,976/month

2024: $1,927/month

Aged Couple, Both Receiving Benefits:

2025: $3,089/month

2024: $3,014/month

Widowed Mother and Two Children:

2025: $3,761/month

2024: $3,669/month

Aged Widow(er) Alone:

2025: $1,832/month

2024: $1,788/month

Disabled Worker, Spouse, and One or More Children:

2025: $3,761/month

2024: $3,669/month

All Disabled Workers:

2025: $1,580/month

2024: $1,542/month

A new year brings new changes to Social Security, and now is the time to start thinking about how they’ll affect your benefits. For more details about 2025 Social Security Changes, please see the 2025 Social Security COLA Fact Sheet here.

Print This Page