Frequently Asked Questions About the Living Trust Plus® Medicaid Asset Protection Trust and Veterans Asset Protection Trust

Because 70 percent of Americans who live to age 65 will need long-term care at some time in their lives, and because 50 percent of all couples and 70 percent of single persons become impoverished within one year after entering a nursing home. You can’t just hide your head in the sand and hope that you are never going to need nursing home care. The best estate plan in the world is useless if you wind up in a nursing home and spend all of your assets on long-term care.

The Living Trust Plus is an irrevocable asset protection trust that you create while you are living; you retain the right to live in any trust-owned real estate, it can be written to allow you to receive all income from the trust assets, but you cannot have direct access to principal.

If either you or your spouse has direct access to principal, the assets in the trust would be deemed “countable” for Medicaid eligibility purposes and would be completely available to almost all other creditors. Prohibiting direct access to principal is the key to why the Living Trust Plus works — for general creditor protection and for Medicaid asset protection.

Yes, if properly funded. So long as all assets are either titled in the Living Trust Plus or name the Living Trust Plus as the beneficiary on death, probate will be avoided.

Possibly. There are two ways that you might have indirect access to the trust principal. The first way is that the trust is written so that the Trustee has the ability to make distributions of principal to the trust beneficiaries, who are typically your adult children. If the Trustee distributes principal to a trust beneficiary, that beneficiary can, but is not required to, return some of that principal to you or use it for your benefit.

There must not be any prior agreement that a trust beneficiary will return some of that principal to you or use it for your benefit. The second way for the settlor to get at the trust principal is for the trust to be terminated, as explained below.

The Living Trust Plus® Medicaid Asset Protection Trust is an irrevocable trust, and many people, including lots of good estate planning attorneys, think that means the trust can never be revoked. But the fact is that the term “irrevocable” means only one thing – that the trust cannot be unilaterally revoked by the creator of the trust.

Although the Living Trust Plus® Medicaid Asset Protection Trust is irrevocable and can’t be revoked unilaterally by the settlor, it can be modified by the settlor (who can change the beneficiaries and trustees without anyone’s permission), and it can be terminated or partially terminated upon the consent of the settlor, the trustee (often the settlor is the trustee), and all trust beneficiaries (usually the adult children of the settlor).

Typically clients who are in their mid-60s to mid-80s, already retired, and worried about the potentially catastrophic cost of long-term care, and they want to protect the nest egg that they’ve been saving for a rainy day.

The rainiest possible day for most people is the day they start needing nursing home care, and if they want to truly protect their nest egg and have it actually benefit them when the time comes, they know they need to do something to shelter that money. The Living Trust Plus® Medicaid Asset Protection Trust, for many people, is the best way to do that.

Most Living Trust Plus® Medicaid Asset Protection Trust clients don’t have long-term care insurance because they’re too old to afford it or to qualify for it, or they have a medical condition that prohibits them from getting it. For many clients, the Living Trust Plus® Medicaid Asset Protection Trust is the best possible alternative to purchasing long-term care insurance to cover nursing home expenses. However, having both long-term care insurance (or hybrid long-term care coverage) AND the Living Trust Plus® Medicaid Asset Protection Trust provides the best coverage because long-term care insurance covers in-home care and assisted living, whereas Medicaid only pays for nursing home care or the nursing home level of care received at home.

The main types of assets that should be funded into the Living Trust Plus® Medicaid Asset Protection Trust are real estate, any nonqualified (after-tax) financial investments, ordinary bank accounts, and life insurance.

There is never tax due by the recipient of the gift. Very rarely a gift tax due by the giver of the gift. Many people confuse the annual gift tax exclusion with the lifetime gift tax exemption, but these are entirely different. Let’s try to clear up the confusion:

The Annual Gift Tax Exclusion. The annual gift tax exclusion is the amount that can be given away by an individual (or by the trustee of the Living Trust Plus) in any given year to an unlimited number of people free from any federal gift tax consequences at all. For example, if you have three children, you (or the trustee of your Living Trust Plus) could give away the annual gift tax exclusion amount ($17,000 as of 2023) to each of your children each year, and these transfers to your children are completely disregarded for federal gift tax purposes and need not be reported.

The Lifetime Gift and Estate Tax Exemption. In addition to the annual gift tax exclusion amount, there is a lifetime gift tax exemption amount, which is the total amount that can be given away (over and above any annual exclusion gifts) by an individual (or by the trustee of the Living Trust Plus) over the individual’s entire lifetime. The lifetime gift tax exemption is the same as the federal estate tax exemption so that if you (or the trustee of the Living Trust Plus) give away any amount of your lifetime gift tax exemption, then this amount will be subtracted from your estate tax exemption when you die. For 2023, the lifetime federal gift tax exemption, which is the same as the federal estate tax exemption, is $12.92 million per individual (double this for a married couple).

Federal Gift Tax Return. If annual transfers are made in excess of the annual exclusion amount, then a Federal Gift Tax Return (IRS Form 709) needs to be filed by the giver of the gift by April 15th of the calendar year following the date of the gift. As stated above, there is a gift tax annual exclusion for gifts of $17,000 per person per year or less (as of 2023), and there is a lifetime exemption equivalent to $12.92 million per individual (double this for a married couple), which is the same as the federal estate tax exemption, so no gift tax will be due unless your total gifts (including gifts made by the trustee of the Living Trust Plus to beneficiaries of the trust) exceed the amount of this lifetime exemption. The annual exclusion amount and lifetime exclusion amount are currently set to increase for inflation in the future. If you have an accountant who does your taxes, you should have your accountant prepare Form 709. If you don’t have an accountant, our firm does -- and we can prepare Form 709 for an additional charge.

No. The capital gains tax implications of selling a home from the trust are no different than if you sold it yourself as an individual. The Living Trust Plus does not affect the $250k capital gains exclusion available to each owner on the sale of a primary residence.

No. The Living Trust Plus is completely tax neutral – i.e., it will have no effect on your income tax, capital gains tax, gift tax, or estate tax.

Although qualified assets can’t be transferred into the Living Trust Plus® Medicaid Asset Protection Trust because of IRS regulations, it sometimes makes very good sense to liquidate your qualified plans and transfer the after-tax balance into the Living Trust Plus Asset Protection Trust. Although “conventional wisdom” typically recommends postponing paying taxes as long as possible, every rule has its exception. For example, converting funds from a traditional IRA to a Roth IRA has three significant benefits:

(1) You can avoid future mandatory disbursements from your IRA.

(2) Avoiding future mandatory distributions means your money can grow for a longer time and will grow tax free in a Roth IRA.

(3) By converting funds now, you owe tax at today’s ordinary income rates and will never again have to pay income tax on these funds or the growth in these funds.

These same three exceptions, and a fourth and much greater exception, apply to moving funds from a traditional IRA into an after-tax investment inside the Living Trust Plus:

(1) You avoid future mandatory disbursements from your IRA.

(2) Avoiding future mandatory distributions of principal means your money can grow for a longer time and, if put into tax-free investments, can grow tax-free inside the Living Trust Plus (however, unlike a Roth IRA, the deferred growth may at some point be subject to income taxation).

(3) By converting funds now, you owe tax at today’s ordinary income rates, and neither you nor your heirs will ever again have to pay income tax on these funds. With the enactment of the SECURE Act in 2020, children are no longer able to stretch out inherited IRAs. There is even more reason now for individuals wanting asset protection to cash out their IRA funds (perhaps over several years to lessen the taxes, using tax bracket management for the settlor) to fund a Living Trust Plus Medicaid Asset Protection Trust, or possibly to fund a life insurance policy owned by a Living Trust Plus. This would allow the settlor to protect assets from probate, PLUS lawsuits, PLUS Veterans Benefits (after three years) for qualified wartime veterans, PLUS Medicaid (after five years). This would also allow the trustee to use the amount in the LTP (perhaps amplified due to a death benefit of life insurance purchased inside the LTP) for distributions to generate regular flexible payments to the beneficiaries – similar to a stretch IRA – after the death of the owner, as well as to achieve tax bracket management for the beneficiary.

(4) Lastly, and most importantly, transferring assets from a traditional IRA into the Living Trust Plus protects those assets, after five years, from ever having to be paid to the nursing home for long-term care. Given that 70 percent of adults over the age of 65 will need long-term care, this asset protection feature of the Living Trust Plus is overwhelmingly more significant than the tax savings that might occur by leaving money in a traditional IRA, which, in most states, is completely exposed to nursing home expenses.

No one knows if or when the federal government is going to raise tax rates, or whether your beneficiaries will be in a higher tax bracket. Assuming that either or both of these scenarios could become true, then converting now makes good sense. That is because paying the tax bill at your lower rate will ultimately produce more cash for your heirs than if you left the money in a traditional IRA and they paid the tax. See also: http://www.usatoday.com/money/perfi/taxes/2011-05-05-tax-cut-record-low_n.htm wherein USA Today states that “Americans are paying the smallest share of their income for taxes since 1958,” meaning that there is a significant change of taxes increasing over the years. And this was before the tax rates were reduced in 2016. Click here for the current federal tax brackets. Using optimal tax bracket management, many people do take out significant sums from the qualified retirement accounts, pay the minimal additional taxes at their current tax rate or just a slightly higher tax rate (for example, paying 24 percent on some of the withdrawals instead of 22 percent), and put the after-tax amounts into the Living Trust Plus.

Keep in mind that if and when you withdraw that money from the IRA, the withdrawn amount is 100 percent subject to income tax at whatever the prevailing income tax rates are at that time.

However, it’s important to understand that income tax rates are currently at their lowest in our country’s history.

As for when to take money out of your IRA if you’re looking to protect it using the Living Trust Plus®, please keep in mind that as a result of the Tax Cuts and Jobs Act (TCJA) that was signed into law on December 22, 2017, the top income tax rate fell from 39.6 percent to 37 percent, while the 33 percent bracket dropped to 32 percent, the 28 percent bracket to 24 percent, the 25 percent bracket to 22 percent, and the 15 percent bracket to 12 percent. The lowest bracket remained at 10 percent, and the 35 percent bracket was also unchanged. However, these changes are temporary, set to expire at the end of 2025. See the charts and explanations on this page for more information.

All that being said, some people with a lot of money in IRAs or other tax-qualified retirement accounts are not good candidates for the Living Trust Plus asset protection trusts. For these people, we may instead suggest they engage us to assist with long-term care financial planning and retirement planning to come up with other ways to help pay for long-term care if and when needed.

A married couple will most typically create one combined trust (through blended families with different wishes often create two separate trusts), and nothing changes on the death of one spouse, as the trust (or both trusts) were already irrevocable prior to death. For married couples with estates larger than the Estate Tax exemption equivalent amount (for 2023, the lifetime gift tax exemption is $12.92 million per individual -- double this for a married couple -- which is the same as the federal estate tax exemption. the Living Trust Plus is designed to utilize both exemptions.

The assets that shouldn’t be transferred into the Living Trust Plus® are your qualified retirement plans (e.g., IRAs and 401(k) plans) and your primary checking account. Most states treat qualified retirement plans as countable resources for Medicaid.

So if you want to protect the assets in your qualified retirement plan from Medicaid by using the Living Trust Plus you will need to cash out your retirement plan first, and pay any income taxes that are due as a result of terminating the plan. We usually do not put annuities into the trust either, but it depends on the type of annuity.

Yes. There are three different versions, explained below and in the following FAQs.

In the first version, which is most often recommended, the creator of the trust retains no ability to receive distributions directly from the trust. This version is simpler to operate mechanically and for tax purposes than the second and third versions. With the first version, the Living Trust Plus® Total Protection Trust, the trust maker is taxed on all income generated by trust assets (though the trust maker does not receive the income, which is simply reinvested inside the trust). At the end of this FAQ is a diagram of the Living Trust Plus® Total Protection Trust.

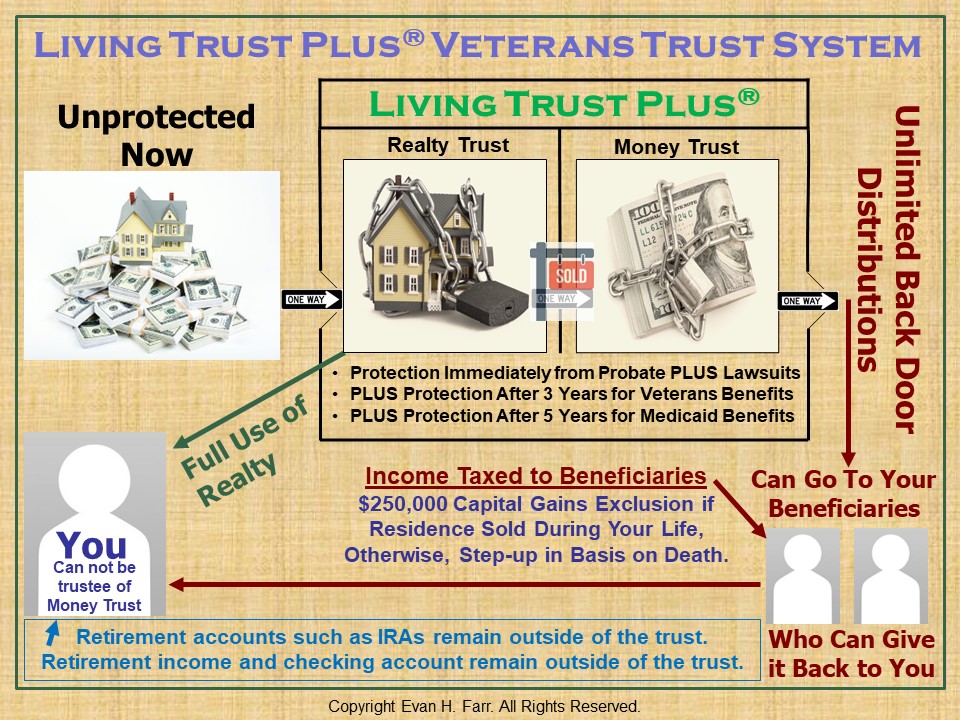

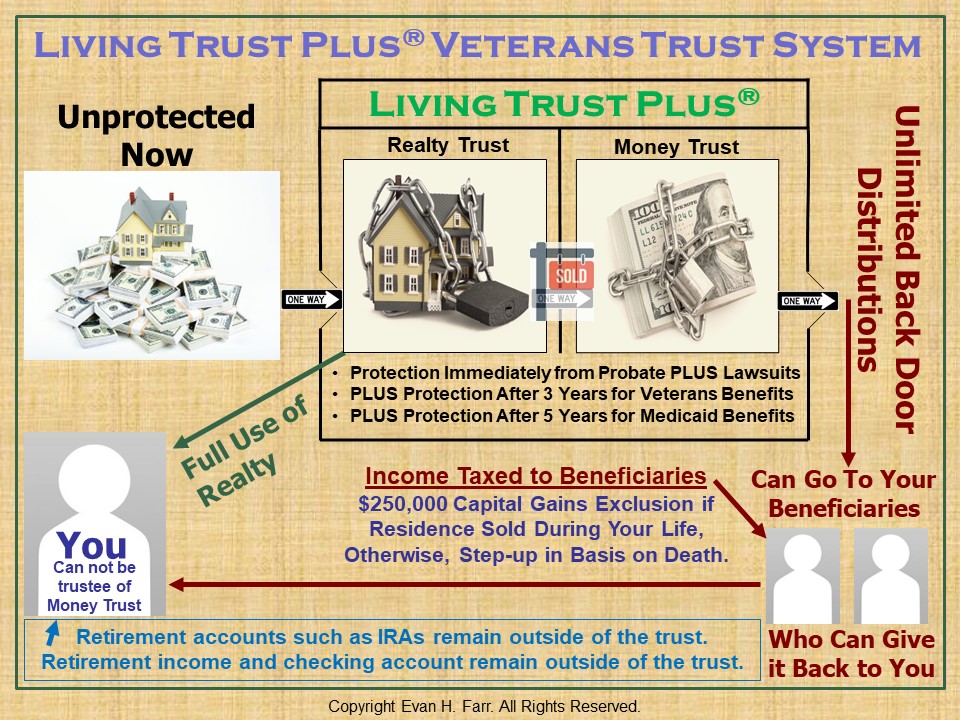

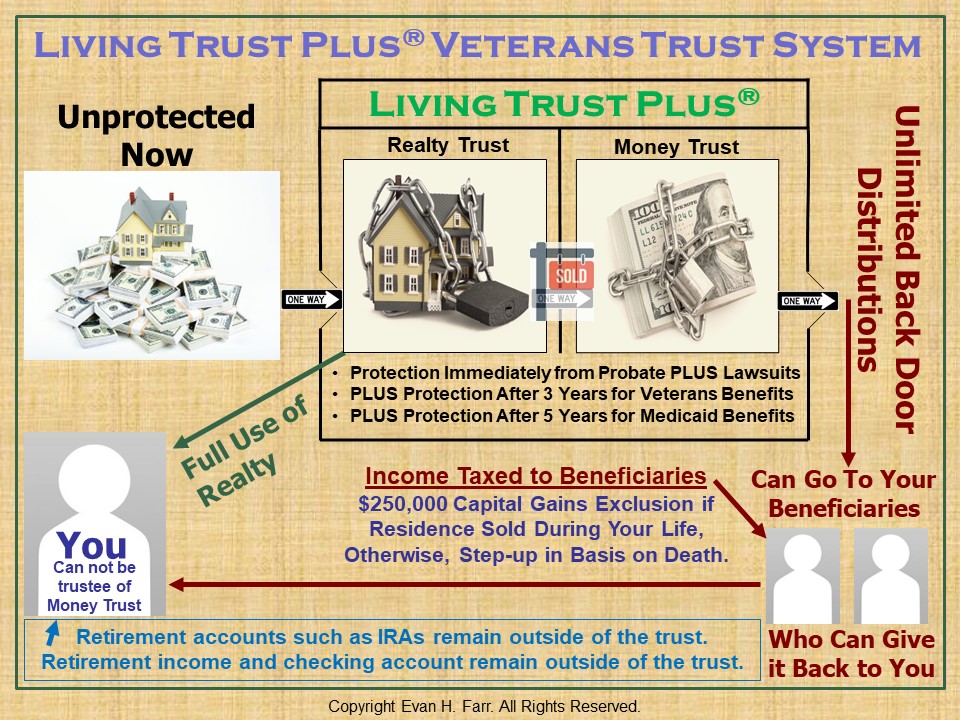

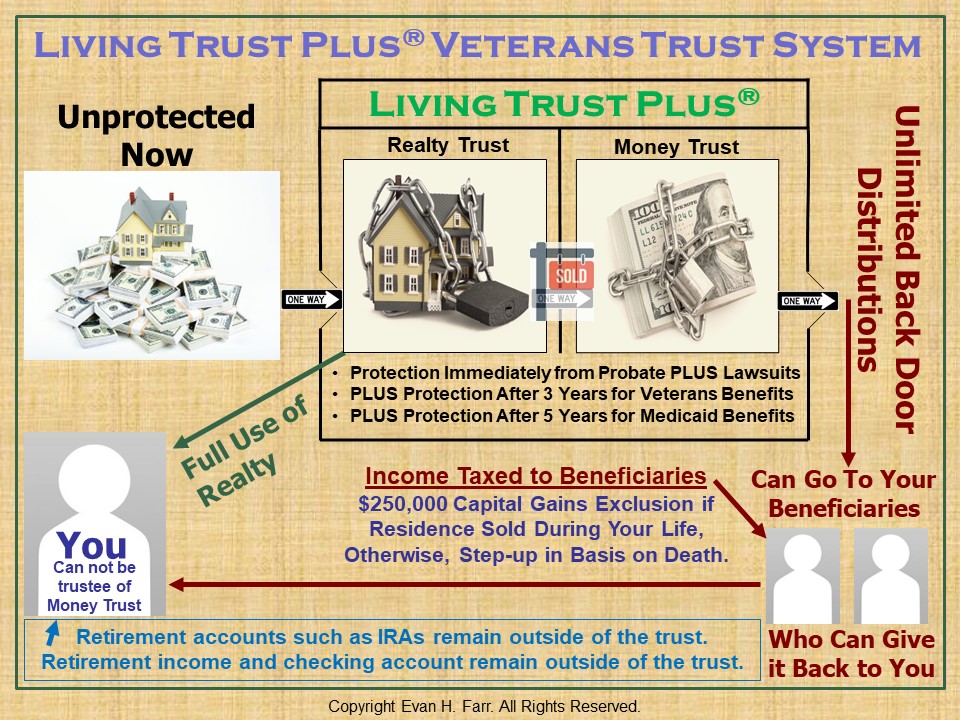

The second version is the version that works best for Veterans desiring to protect assets in connection with the Veterans Aid and Attendance Benefit and Medicaid. With the second version, the Living Trust Plus® Veterans Trust, the primary residence goes into its own Realty Trust and money goes into a Money Trust; the beneficiaries of the Money Trust are taxed on all income generated by trust assets, though the beneficiaries may or may not request to receive the income. At the end of this FAQ is a diagram of the Living Trust Plus® Veterans Version.

This Income Distribution or Income Only version of the trust is most often used by individuals who rely on monthly rental income to maintain their standard of living. The third version allows the creator of the trust the optional right to receive distributions of ordinary income directly from the trust. This third version, called the Income Distribution Trust, and sometimes called an “Income Only Trust,” protects your assets from probate PLUS lawsuits, PLUS nursing home expenses (like the other two versions), but is more complicated to operate and does not protect your assets in connection with the Veterans Aid and Attendance Benefit. At the end of this FAQ is a diagram on the Living Trust Plus® Income Distribution Trust:

Medicaid Asset Protection Trust | Living Trust Plus® Total Protection Trust Medicaid Asset Protection Trust | Veterans Asset Protection Trust |

Veteran Pension Asset Protection Trust

Medicaid Asset Protection Trust | Veterans Asset Protection Trust |

Veteran Pension Asset Protection Trust

Medicaid Asset Protection Trust |

Medicaid Income-Only Trust | Living Trust Plus® Income Only Trust

Medicaid Asset Protection Trust |

Medicaid Income-Only Trust | Living Trust Plus® Income Only Trust

In the first version, which is most often recommended, the creator of the trust retains no ability to receive distributions directly from the trust. This version is simpler to operate mechanically and for tax purposes than the second and third versions. With the first version, the Living Trust Plus® Total Protection Trust, the trust maker is taxed on all income generated by trust assets (though the trust maker does not receive the income, which is simply reinvested inside the trust). At the end of this FAQ is a diagram of the Living Trust Plus® Total Protection Trust.

The second version is the version that works best for Veterans desiring to protect assets in connection with the Veterans Aid and Attendance Benefit and Medicaid. With the second version, the Living Trust Plus® Veterans Trust, the primary residence goes into its own Realty Trust and money goes into a Money Trust; the beneficiaries of the Money Trust are taxed on all income generated by trust assets, though the beneficiaries may or may not request to receive the income. At the end of this FAQ is a diagram of the Living Trust Plus® Veterans Version.

This Income Distribution or Income Only version of the trust is most often used by individuals who rely on monthly rental income to maintain their standard of living. The third version allows the creator of the trust the optional right to receive distributions of ordinary income directly from the trust. This third version, called the Income Distribution Trust, and sometimes called an “Income Only Trust,” protects your assets from probate PLUS lawsuits, PLUS nursing home expenses (like the other two versions), but is more complicated to operate and does not protect your assets in connection with the Veterans Aid and Attendance Benefit. At the end of this FAQ is a diagram on the Living Trust Plus® Income Distribution Trust:

Medicaid Asset Protection Trust | Living Trust Plus® Total Protection Trust

Medicaid Asset Protection Trust | Veterans Asset Protection Trust |

Veteran Pension Asset Protection Trust

Medicaid Asset Protection Trust | Veterans Asset Protection Trust |

Veteran Pension Asset Protection Trust

Medicaid Asset Protection Trust |

Medicaid Income-Only Trust | Living Trust Plus® Income Only Trust

Medicaid Asset Protection Trust |

Medicaid Income-Only Trust | Living Trust Plus® Income Only Trust

In the first version, which is most often recommended, the creator of the trust retains no ability to receive distributions directly from the trust. This version is simpler to operate mechanically and for tax purposes than the second and third versions. With the first version, the Living Trust Plus® Total Protection Trust, the trust maker is taxed on all income generated by trust assets (though the trust maker does not receive the income, which is simply reinvested inside the trust).

The second version is the version that works best for Veterans desiring to protect assets in connection with the Veterans Aid and Attendance Benefit and Medicaid. With the second version, the Living Trust Plus® Veterans Trust, the primary residence goes into its own Realty Trust and money goes into a Money Trust; the beneficiaries of the Money Trust are taxed on all income generated by trust assets, though the beneficiaries may or may not request to receive the income.

The second version is the version that works best for Veterans desiring to protect assets in connection with the Veterans Aid and Attendance Benefit and Medicaid. With the second version, the Living Trust Plus® Veterans Trust, the primary residence goes into its own Realty Trust and money goes into a Money Trust; the beneficiaries of the Money Trust are taxed on all income generated by trust assets, though the beneficiaries may or may not request to receive the income.

This Income Distribution or Income Only version of the trust is most often used by individuals who rely on monthly rental income to maintain their standard of living. The third version allows the creator of the trust the optional right to receive distributions of ordinary income directly from the trust. This third version, called the Income Distribution Trust, and sometimes called an “Income Only Trust,” protects your assets from probate PLUS lawsuits, PLUS nursing home expenses (like the other two versions), but is more complicated to operate and does not protect your assets in connection with the Veterans Aid and Attendance Benefit.